Infographic: Gold and the best 5 Reasons to own it! (Diversify Portfolio, Store of value, Safe haven, The fundamentals, Contrarianism and value.

Your Products

You have no items in your shopping cart.

Infographic: Gold and the best 5 Reasons to own it! (Diversify Portfolio, Store of value, Safe haven, The fundamentals, Contrarianism and value.

NEW YORK (MarketWatch) — Gold prices pushed above US$1,300 on Thursday propelled by continued tension in Iraq and signals from Federal Reserve Chairwoman Janet Yellen that short-term rates can be held steady for a while longer.

Gold for August delivery GCQ4 +0.20% jumped $41.40, or 3.3%, to settle at $1,314.10 an ounce on the Comex division of the New York Mercantile Exchange. That’s the highest level since April 14, tracking the most-active contracts, according to FactSet data. July silver SIN4 +0.42% added 87 cents, or 4.4%, to end at $20.65 an ounce.

President Barack Obama said Thursday the government would send 300 military advisers to Iraq amid escalated violence. The U.S. has indicated that it wants a government in Iraq that can work with the country’s Sunni population, perhaps one without current Prime Minister Nouri al-Maliki, according to The Wall Street Journal.

Iraq has been “a background factor that’s helping to elevate gold,” said Brien Lundin, editor of Gold Newsletter. “I think the generally dovish interpretation of the Fed policy statement yesterday has also helped gold,” he said, adding that the two factors pushed gold futures toward technical levels that further accelerated gains.

Yellen on Wednesday refused to shed light on when the central bank could hike interest rates, emphasizing that there’s no “mechanical formula” for future increases. She also said that recent inflation data were “noisy,” dismissing some speculation that the Fed could tighten policy based on data showing higher inflation. A continuation of low interest rates in the U.S. would benefit gold, as they make alternative assets such as gold more attractive.

Still, the market is beginning to appreciate that “retail price inflation will become an issue in the U.S. economy,” said Lundin.

The dollar DXY -0.01% fell against major rivals Thursday, making dollar-denominated commodities less expensive for foreign investors.

Weekly jobless claims declined by 6,000 to 312,000 last week, roughly in line with expectations, according to data released Thursday.

“Geopolitical flash points will continue to be very closely monitored for new developments,” said Kitco’s Jim Wyckoff. “Both situations are likely to worsen before they become better. The gold market, crude oil, U.S. Treasuries and the U.S. dollar should all at least see limited selling interest as these two developments play out.”

Elsewhere in metals trading, July platinum PLN4 -0.42% added $23.70, or 1.6%, to end at $1,474.50 an ounce, while September palladium PAU4 -0.35% rose $15.95 or 1.9%, to settle at $838.60 an ounce. High-grade copper for July delivery HGN4 -0.18% added 2 cents, or 0.6%, to end at $3.08 a pound.

Author: Saumya Vaishampayan is a MarketWatch reporter based in New York. You can find her on Twitter @saumvaish.

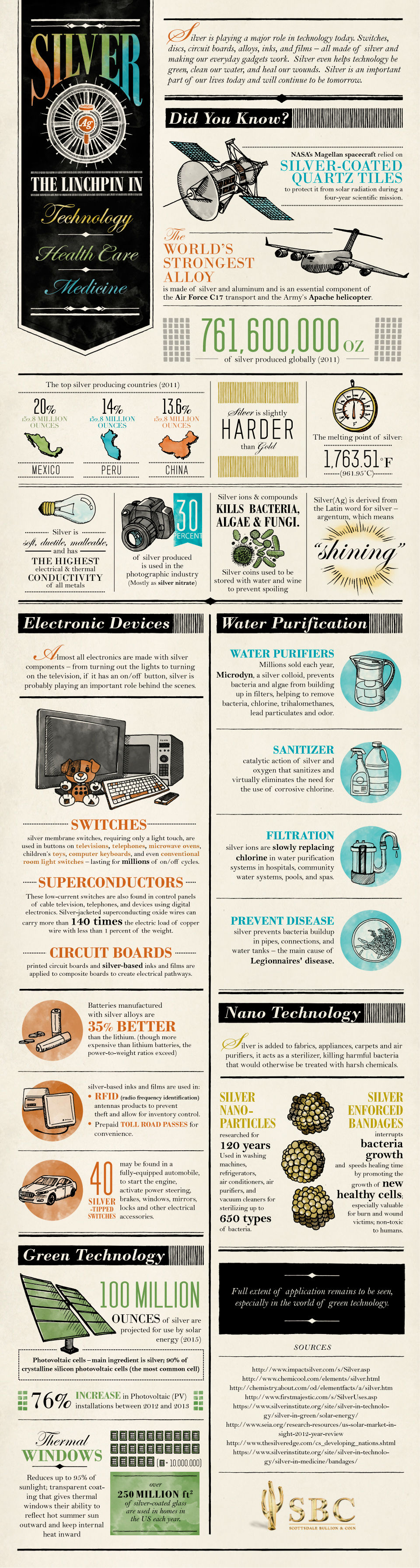

Here is the latest infographic for silver, outling the importance of this element in modern day technology, health care and medicine.

Gold prices are again modestly higher in last night trading and hit a two-week high in US dollars. Short covering and bargain hunting have been featured the past few sessions, as gold prices have risen around $25 from the lows posted less than two weeks ago. Now, some safe-haven demand is also surfacing due to unrest in Iraq. August Comex gold was last up $4.30 at $1,265.60 an ounce. Spot gold was last quoted up $4.90 at $1,266.00. July Comex silver last traded up $0.098 at $19.265 an ounce.

Iraq is back in the news headlines again, as civil war has broken out in that country amid escalating violence. Iraq’s ruling government is calling on the U.S. for military aid, although such is not likely. Crude oil prices are sharply higher Thursday, mostly on the Iraq news. Gold is also seeing modest safe-haven buying support on the news. The bigger worry is that the violence in Iraq could spread to other Arab countries.

In other overnight news, industrial production in the European Union rose 0.8% in April from March and was up 1.4% year-on-year. The increase was a bit larger than forecast.

U.S. economic data due for release Thursday includes the weekly jobless claims report, import and export prices, and retail sales.

And let us not forget about Ukraine when it comes to geopolitical risks. There have been reports from last night that three Russian tanks crossed the border at a rebel controlled checkpoint in the Luhansk region, amid escalated fighting. While focus has shifted back to the Middle East, risks in Eastern Europe remain considerable.

MACRO: A new day, a new record for US stocks, amid continued optimism about the US economy

and another round of M&A activity. The S&P500 reached its eleventh winning session in the past

thirteen and its seventh record close in the past eight trading days. The S&P finished 1.83 points

higher (+0.09%), the Dow Jones edged 18.82 points higher (+0.11%), whilst the Nasdaq was the

best performing bourse, gaining 14.84 points (+0.34%). There were wins for industrials (+0.6%),

financials (+0.4%) and tech stocks (+0.3%), whilst utilities (-0.7%), healthcare (-0.5%), materials (-

0.3%) and staples (-0.1%) all finished the day in the red. With a lack of economic data, investors

appeared to focus on a number of mergers and acquisitions, whilst remaining upbeat and

encouraged by last weeks strong data releases. Accommodative central bank policies, improving

data and bullish views on corporate earnings around the globe have helped push stocks higher in

recent weeks/months, with a number of major index's touching record highs. The European markets

were also higher on Monday, with the smaller markets such as Spain, Italy and Portugal leading the

way. The FTSEurofirst 300 index rose by 0.4%, while both the German Dax and UK FTSE finished

0.2% higher. The Spanish market tacked on 0.9%, Italy closed 0.8% higher whilst Portugal's main

bourse closed 0.6% firmer.

US long term Treasury prices pulled back overnight as investors continue to switch from safe haven

assets such as gold and bonds into equities. US two year yields were up by 2 points to 0.427%,

while US 10 year yields rose by 2 points to 2.611%. The VIX 'complacency' gauge rose by 2.6% to

11.01 whilst the dollar index rose by 0.3% to 80.633. The top performer in the G10 was the CAD,

rising by 0.2% followed by the Aussie, which was up by a similar margin. The euro slid from highs of

around 1.3665 at the close of Asia yesterday to finish the day at 1.3580. The USD/JPY range

traded between 102.37-102.59, whilst the worst performers were the scandis. The SEK was down

0.9% on the day and the NOK finished 0.5% lower.

Not much in the way of US economic data. The employment trends index increased from 117.32 to

118.58 in May, which is following on from the non farm payrolls number on Friday showing a

217,000 rise in employment, with unemployment stable around 6.3%.

There was a little Fed chatter overnight. Eric Rosengren was on the wires stating that the Fed may

need to implement a second tapering of its bond buying program. He said "As the economy moved

closer to the Federal Reserve's 2% inflation target and full employment, there could be a gradual

reduction in the reinvestment policy-which would allow for a predictable reduction in the size of the

balance sheet...A reduction in the balance sheet, when that becomes appropriate, could be

implemented as a basically seamless continuation of the tapering program used for reductions in

the purchase program...and the Fed...could decide to reinvest all but a given percentage of

securities on the balance sheet as they reach maturity, and increase that percentage at each

subsequent meeting, assuming conditions allow." Rosengren once again offered his strong support

for aggressive action to support the economy. "I personally do not expect that it will be appropriate

to raise short-term rates until the U.S. economy is within one year of both achieving full employment

and returning to within a narrow band around 2% inflation." James Bullard was also on the wires,

saying that if the economy performs as he expects for the remainder of the year, it is likely rates will

rise sooner than expected. He said “If you get 3% growth for the rest of this year, if you get

unemployment coming down below 6%, if you continue to have jobs growth at 200,000, if you

continue to see inflation moving back up toward target, I think if we get to the fall of the year and all

of those things are transpiring as I’m suggesting they will, that will change the conversation about

monetary policy, and there will be more sentiment toward an earlier rate hike,”

PRECIOUS METALS: Very little to report overnight in the precious space, as gold experienced its

lowest trading volumes on comex since December 2013! Turnover was less than 52,000 lots, as all

attention seems to be squarely on the record breaking equity indices.

Gold pushed to the days highs in European trade, as the market ground its way up to 1257, but the

marginal gains weren't sustainable and New York were happy to sell into the rally, pushing gold

back down towards 1253, but as mentioned, volumes and interest were on the low side. The high of

1257 has now become a mini triple top on the hourly charts, and momentum is certainly lacking as

any rally seems to be faded and looked upon as a selling opportunity. Vols continue to drift lower as

one month is currently around 11.1 versus 11.75 yesterday, and short dated downside options

seem to be gaining the markets attention. Silver wasn't much better, trading in a minute 14 cent

range.

Further reports overnight in regard to the ongoing dispute between the South African platinum

producers and unions continue to influence the PGM markets.

Despite the headlines, platinum traded within a $10 range between 1445-55, closing at 1451.

Also making news were reports that Deutsche Bank has begun operating a precious metals vault in

London, with a capacity of 1,500 tonnes, significantly larger than its Singapore vault which can hold

200 tonne.

ASIA TODAY: Precious metals in Asia were quiet again today, following on from the minuscule

$4.50 range overnight. Globex opened to some light supply, around 1252. There were small stops

triggered on the exchange on the break of the overnight low, pushing gold down to the lows of the

day, just above 1250. A couple of sweeps of selling in August were not enough for to break 1250,

and resting bids on the futures prevented the market falling any further. After touching 1250.10

GCQ4 just after the Globex open the market settled back where it opened at 1252 awaiting the

Shanghai Gold Exchange. The premium on the SGE was around $2 which provided a small bid to

gold. The yellow metal edged a couple of dollars higher, reaching 1254 not long after the fix which

is where the market remained for the rest of the day. The SGE premium has been as high as $3 in

the last few trading sessions, but for the time being seems capped around the $2.50 level, which is

likely due to importers eager to lock in any kind of premium as there have been so few opportunities

in recent months.

Palladium futures jumped to a 39-month high and platinum headed for the longest rally since April after South African government mediation failed to end a 19-week strike at the largest mining companies. Gold advanced.

Anglo American Platinum Ltd., Impala Platinum Holdings Ltd. and Lonmin Plc said they will consider steps to end the dispute. More than 70,000 mineworkers have been on strike since January in South Africa, the world’s largest producer of platinum and the second-biggest for palladium.

Several rounds of talks have failed to end the impasse that has idled 60 percent of output and caused the economy to contract in the first quarter. Through yesterday, palladium gained 17 percent this year and platinum rose 5.9 percent. Demand for the metals, used for pollution-control devices in vehicles, will exceed supplies for the third straight year, Johnson Matthey Plc data show

“The strike remains unresolved, and this could rumble on for some time,” Robin Bhar, an analyst at Societe Generale SA in London, said in a telephone interview. “That will gradually tighten up supply. There’s quite a bullish outlook from the demand side” as consumption by car companies increases, he said.

Palladium futures for September delivery rose 1.4 percent to $853.50 an ounce at 11:03 a.m. on the New York Mercantile Exchange. Earlier, the price reached $855.65, the highest for a most-active contract Feb. 22, 2011.

Platinum futures for July delivery gained 1.8 percent to $1,481.10 an ounce. The price headed for the fifth straight gain, the longest rally since April 4. Trading was 60 percent above the average for the past 100 days for this time, data compiled by Bloomberg showed.

Job Cuts

The strike by members of the Association of Mineworkers and Construction Union has cost companies about 22 billion rand ($2.1 billion). The latest negotiations were overseen by Minister of Mineral Resources Ngoako Ramatlhodi, and the chances of job cuts at mines are rising, he said.

A union official said members will meet starting today on a response to the outcome of talks.

“People are getting very worried that the supply situation is worsening as the strike prolongs,” Phil Streible, a senior commodity broker at R.J. O’Brien & Associates in Chicago, said in a telephone interview. “We could see prices climbing higher.”

Johnson Matthey

Palladium demand will top supplies by 1.6 million ounces this year and platinum’s shortfall will be 1.2 million ounces, according to data from London-based Johnson Matthey, which makes a third of the world’s catalytic converters.

Holdings in exchange-traded products backed by palladium and platinum have climbed to records, according to Bloomberg data.

On the Comex in New York, gold futures for August delivery rose 0.5 percent to $1,260.30 an ounce. Earlier, the price reached $1,263.80, the highest since May 28.

Last month, gold fell 3.9 percent, the most this year. The price touched a 17-week low of $1,240.20 on June 3.

“Gold appears to be steadying after the May slump,” Howard Wen, an analyst at HSBC Securities (USA) Inc., said in a note. “We do expect the recent price decline to encourage some emerging market bullion demand, but we do not believe this has fed into more stable gold prices, at least not yet.”

Silver futures for July delivery rose 0.7 percent to $19.19 an ounce. Earlier, the price reached $19.245, the highest since May 27.

BY NICHOLAS LARKIN AND DEBARATI ROY, BLOOMBERG