NEW YORK (MarketWatch) — Gold prices pushed above US$1,300 on Thursday propelled by continued tension in Iraq and signals from Federal Reserve Chairwoman Janet Yellen that short-term rates can be held steady for a while longer.

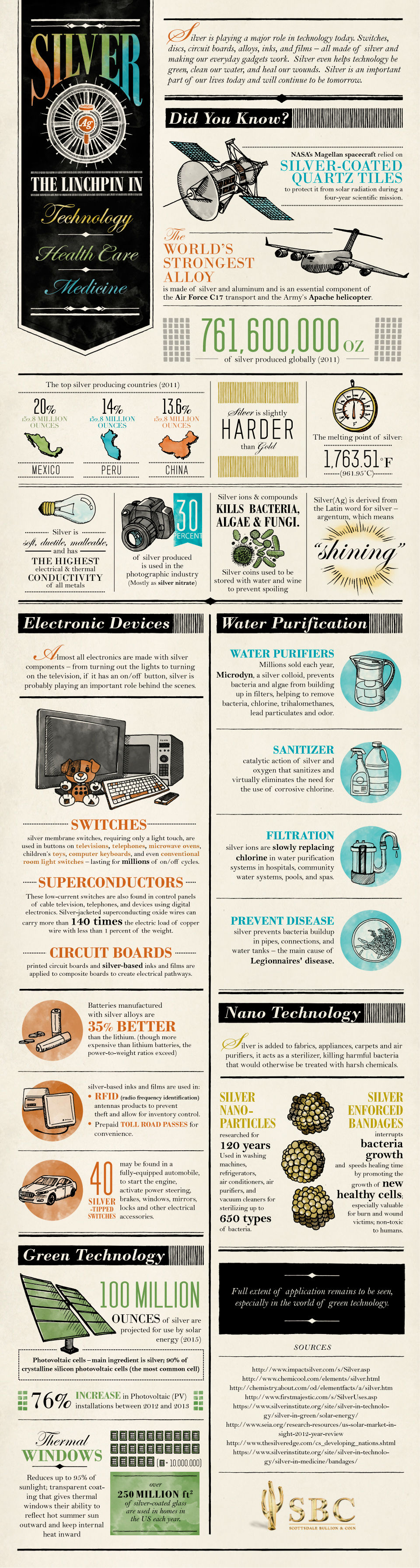

Gold for August delivery GCQ4 +0.20% jumped $41.40, or 3.3%, to settle at $1,314.10 an ounce on the Comex division of the New York Mercantile Exchange. That’s the highest level since April 14, tracking the most-active contracts, according to FactSet data. July silver SIN4 +0.42% added 87 cents, or 4.4%, to end at $20.65 an ounce.

President Barack Obama said Thursday the government would send 300 military advisers to Iraq amid escalated violence. The U.S. has indicated that it wants a government in Iraq that can work with the country’s Sunni population, perhaps one without current Prime Minister Nouri al-Maliki, according to The Wall Street Journal.

Iraq has been “a background factor that’s helping to elevate gold,” said Brien Lundin, editor of Gold Newsletter. “I think the generally dovish interpretation of the Fed policy statement yesterday has also helped gold,” he said, adding that the two factors pushed gold futures toward technical levels that further accelerated gains.

Yellen on Wednesday refused to shed light on when the central bank could hike interest rates, emphasizing that there’s no “mechanical formula” for future increases. She also said that recent inflation data were “noisy,” dismissing some speculation that the Fed could tighten policy based on data showing higher inflation. A continuation of low interest rates in the U.S. would benefit gold, as they make alternative assets such as gold more attractive.

Still, the market is beginning to appreciate that “retail price inflation will become an issue in the U.S. economy,” said Lundin.

The dollar DXY -0.01% fell against major rivals Thursday, making dollar-denominated commodities less expensive for foreign investors.

Weekly jobless claims declined by 6,000 to 312,000 last week, roughly in line with expectations, according to data released Thursday.

“Geopolitical flash points will continue to be very closely monitored for new developments,” said Kitco’s Jim Wyckoff. “Both situations are likely to worsen before they become better. The gold market, crude oil, U.S. Treasuries and the U.S. dollar should all at least see limited selling interest as these two developments play out.”

Elsewhere in metals trading, July platinum PLN4 -0.42% added $23.70, or 1.6%, to end at $1,474.50 an ounce, while September palladium PAU4 -0.35% rose $15.95 or 1.9%, to settle at $838.60 an ounce. High-grade copper for July delivery HGN4 -0.18% added 2 cents, or 0.6%, to end at $3.08 a pound.

Author: Saumya Vaishampayan is a MarketWatch reporter based in New York. You can find her on Twitter @saumvaish.

WE HAVE A NEW WEBSITE.

WE HAVE A NEW WEBSITE.